One can easily find CRM glossaries online, and some of them are really good. Still, we could not find a glossary that is specific to retail and that could explain the practical usage of the main components of CRM for our own growing Teams.

So, we decided to build our own. If we are lucky, our little efforts will also be useful to others

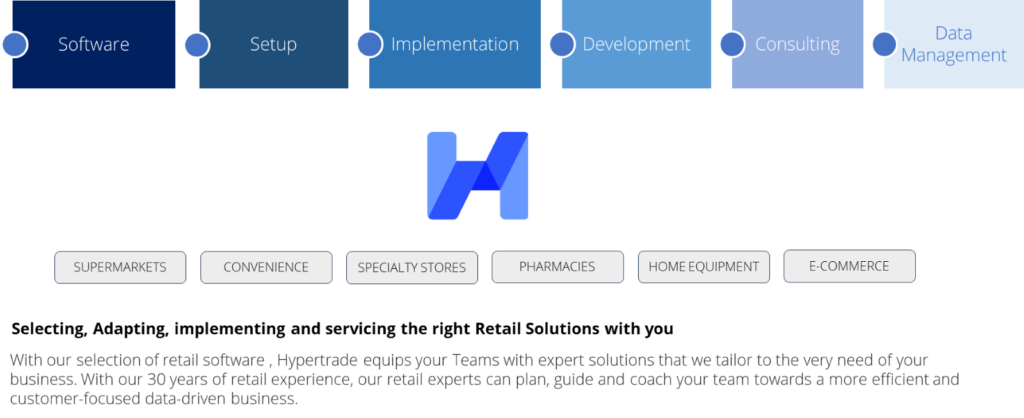

Ulys Customer Intelligence SaaS Software ™ is a Retail CRM online Solution published by HPT Ariane Ltd, South East Asia Leading Retail Collaboration Platform.

Fed by POS Data, ERP and CRM Data, Ulys Customer Intelligence SaaS Software ™ is a tool that enable retailers and marketers to understand customers purchase and non-purchase decisions.

Developed by and for retailers, Ulys Customer Intelligence SaaS Software ™ is both offering simplicity in its usage as well as a really deep level or granularity.

Ulys Customer Intelligence SaaS Software ™ is articulated around functionalities:

- CRM Performances & Profitability Dashboards

- Purchase behaviour

- Basket Analyses

- Purchase Trends

- Customer Segmentation

- Promotions

- Customers history

Like many companies, our CRM activity is growing fast. Retailers are in high demand of improved CRM solutions and advanced Analytics. So, our Teams working on the development of our CRM Tools, as well as our Teams commercializing these solutions, are growing too. To welcome these newcomers, who might not always have an extensive experience of Retail CRM, we started looking for CRM Training Materials, especially glossaries, online.

One can easily find CRM glossaries online, and some of them are really good. Still, we could not find a glossary that is specific to retail and that could explain the practical usage of the main components of CRM. So, we decided to build our own. If we are lucky, our little efforts will also be useful to others.

Part 1: Customers

Loyal Customers

Is a customer who owns a Loyalty Card – physical or Digital from her preferred Shop. Loyal Customers are often referred to as carded customers, in reference to the loyalty card they own.

Active Customers

Is a Customer that shops at a certain frequency, defined by the retailer. For example, if that frequency level is defined at least one shopping trip every 4 weeks over a period of, say 12 months, every customer that correspond to that pattern (shop at least 1 time every 4 weeks during a period of 12 months) is considered active.

A Customer who shops below a defined threshold of this pattern will be considered as inactive.

New Customer

A new customer is a customer who recently acquired the card. Each company will define its own duration during which a Customer can be labelled as New.

New Customer Onboarding Journey

Defines the several steps a customer will go through from the first interaction with the Loyalty Program (information quality, simplicity and easiness of access), then the registration itself, and the several interaction the retailer will have with her during the first weeks of her experience as a new member of the Loyalty Program Community.

Note: this is a Retail CRM area which is often forgotten by retailers, although it might be one of the most important components of any CRM Strategy. Let’s remember that there is the word Relationship in CRM. And like for all relationships, a good start can promise a great future

Basket

Defines what carded customers buy during a shopping trip, online or in physical stores.

Share Of Wallet (SOW)

Defines the percentage of expenses of a group of products compared to the total basket value. Imagine a Customer spends 10 USD in her store visit. In these 10 USD, 2.75 USD have been spent on toothpaste and toothbrushes. The Oral Care share of Wallet of that customer in that shopping trip is then 27.5%.

The SOW can also be used to measure the customer behavior towards an activity

Imagine you run a promo for a Shampoo valued at 3.9 USD. If the Shampoo SOW is 95%, it means that the shopper came to your store to buy this promo only, indicating that no additional purchase has been generated from the promo.

Housewife Basket (HWB)

Details and rank the products which are the most found in the baskets of Customers. The products that are the most frequently found in the Housewife Basket are therefore the products with the highest penetration rate (see Basket Penetration)

Customer Lifetime Value (CLV)

CLV defines the value a customer will deliver to the retailer during her lifetime, either form a cashflow perspective (sales) or profitably (margin) perspective.

There are several ways of calculating CLV, and one of the most detailed and well explained approaches can be found in this article from Maryna Sharapa.

Part 2: Behaviors

The behaviors we want to focus on here only concerns what happens once the Customer is in the store (physical or digital)

Frequency

Is the number of times a customer shops within a certain time period

Recency

How recently a customer has made a purchase

RFM [Recency-Frequency-Monetary]

RFM analysis numerically ranks a customer in each of these three categories, generally on a scale of 1 to 5 (the higher the number, the better the result). The “best” customer would receive a top score in every category.

ABC Analysis

ABC analysis is a method of analysis that divides the subject up into three categories: A, B and C. It uses the Pareto principles and enables to group customers from the most valuable (A segment) to the least valuable (C segment)

COHORT Analysis

A cohort is a group of people with similar behaviors or characteristics within a certain period of time. Cohort analysis is a type of behavioral analytics, which is primarily identified by breaking down customers into related groups in order to gain a better understanding of their behaviors

Drop From Market

Is a market research term that defines customers who used to buy from a (set of) categori(es) during a certain period of time and then stopped.

New To Market

Is a market research term that defines customers who did not buy from a (set of) categori(es) during a certain period of time and then started.

Switch Gain

Defines, for a Brand, a group of customers who used to buy competitors’ Brands and then switched to their own Brands.

Switch Loss

Defines, for a Brand, a group of customers who used to buy their brand and then switched to their competitors’ Brands.

Part 3: Customer Engagement

Loyalty Program

A loyalty program is a marketing strategy designed to encourage customers to continue to shop at or use the services of a business associated with the program. It is usually embodied by a system of Card, physical or digital, which enables Customers to both accumulate and redeem points – or any other internal currency – as they shop.

Over time, Loyalty Programs have evolved from a Points Bank positioning to a promotion factory as well as active Communities where several benefits and advantages – involving 3rd and related parties – are offered to its members.

The major ongoing trends in Loyalty Programs are:

- Increase of the Customer Centric-Evolution

- Review the Financial and Economics Models of Loyalty Programs

- Presence in various eco-systems and marketplaces

- Increased convergence with payments and Touch-Free

- Data Security

- Ever evolving member expectations

Conversion Rate

Defines the number of customers who used a coupon or other received promotional mechanisms compared to the total number of Customers who received it

Campaign

A campaign is a set of special offers proposed to customers over a period of time. Campaigns can serve several purposes and focus on various targeted members or future members

- Recruitment campaigns to invite new members

- Activation campaign, to stimulated specific member

- Promotion Campaigns

- Private Label Campaigns

- CSR Campaigns

- …

Campaign Management

Is the ability to plan and monitor the several steps of a campaigns to maximise its efficacy and effectiveness. If we compare a Campaign Life Cycle to a Product Life Cycle, specific messages and stimuli will be needed at various stages of the Campaign’s life

Onboarding Journey

Defines the several steps (the Experience) a new member will go through from right after her becoming a member to a certain period in time after the recruitment. It is useful to define these steps as well as setting objectives to the Onboarding Journey.

Churn Rate

The churn rate, also known as the rate of attrition or customer churn, is the rate at which customers stop doing business with an entity. It is often as the percentage of service subscribers who discontinue their subscriptions – de facto or by stopping their shopping – within a given time period.

Churn Management

Every time a customer leaves the program is a great opportunity to learn what happened. Churn Management consists of 4 key points:

- Understand why Customers leave

- Identify Customers most at risk to leave

- Identify among these customers who are the one we want to keep based on the value they bring

- Setup strategies to keep them

Targeted Offer

A targeted offer is a commercial proposition sent to a specific customer based on her shopping preferences and behaviors.

- A targeted offer can be part of a campaign and is anyway managed like a campaign

- A targeted offer can be initiated and financed by the retailer.

- A targeted offer can be initiated by the retailer and sponsored by supplies

By definition, the Targeted offer is personalised.

Part 4: Thoughts on CRM

Initially designed as a Point issuing Bank, CRM has evolved into a sophisticated tool to retain customers.

Technology now enables CRM program Managers to do much more than issuing points: they can create communities, be present in several eco-systems, enlarge the markets for the value of their own internal currency (the Point), understand shopper behaviors and directly interact with them with an adapted offer (i.e. Range, Assortment, Price and Promotion)

Towards a new revenue management system for retailers

During the Pandemic, in locked-down and economically shattered environments, several retailers realised that their bottom line, despite the huge increase of operating costs and potential cash-flow challenges – was not that bad. One of the key reasons is that they had to drastically decrease their promotion and communications.

Still, even as retailers could not publish as many promotions as in the past, most of them successfully maintained suppliers support.

Still, It is probable that it might take some time before the return to massive promotion communication strategies.

Consequently, retailers will have to find new ways of generating additional income from suppliers to compensate the decrease in Promotion Support fees.

The alternative and the big risk

CRM and its ability to build personalised and targeted offers is one of the most attractive alternatives for both physical and digital commerce. Such offers will be more efficient, and their generation of additional traffic and spending will by far surpass, at the member level, the results of previous mass promotions.

At the same time, customers level of satisfaction will also grow since the offer they will receive will be truly relevant to their needs and aspirations. And the fees income will be much greater, by product, than these generated through mass promotion communication.

The big risk for retailers and marketers is to over-exploit the direct and personalised engagement opportunities technology offers today. New business rules will have to be established to ensure that the retailers don’t become another nuisance on the Customer’s mobile phone or email inbox.

CRM Management needs a re-think

At the very beginning of CRM, the CRM Manager was essentially a Finance expert: she was managing points, evaluating their impact of the margin and balance sheet. Her work and analyses were driving the financial value of the point and the redeem strategies.

CRM Management is today at a stage when CRM Managers have developed advanced analytical skills to understand shoppers, adapt their commercial offer accordingly, and build strategies: traffic pull, spending push and retention.

Today, CRM Teams face a new challenge: address what customers want more than money. Most researches on the subject agree that what matters most for customers is a collaborative relationship where consideration is the highest value currency. “Can’t buy me Love” as the song goes.

In other words, it means that CRM Teams need to find ways to entertain personal relationships with millions of individuals simultaneously. Emotions are as important as transactions.

Yes, of course technology will help. But technology will only help automate a set of business rules and communication engagement that Teams will setup (and yes again: Machine Learning will help optimise them).

So the paradigm-shift is here: the future of CRM and Customer engagement needs to accelerate its migration from “Mostly Transactional” to “Emotional and Transactional”.

In practice, it means that CRM Teams will have to change some of the usually asked questions like “How much should we invest / Finance” in such or such customer scenario into “What Question Should we ask?” or “What would be the best thing to say?”

From an operational perspective, it implies that Teams will have to setup new workflows, new metrics and new rules to address all the non-transactional aspects of the relationship and remain consistent with the Retailer’s vision on the omni-channel Customer Experience it wants to offer.