For more than a year now, Assortment Rationalization has become a priority for many retailers. The frequent change of customer behaviors and the fear of a recession looming are being translated in a noticeable decrease in spending. This decrease in spending can be measured by both a decrease in volume as well as a decrease in the variety of products purchased, dragging the profitability per square foot down. Consequently, for cash flow and cost purposes, reducing the number of products in ranges – mostly in physical stores – is on top of retailers’ agenda. While it undoubtedly makes business and customer sense, the way it is designed and implemented can have either the effects of surgery with a chainsaw or laser-precise incisions.

Victims of Rationalization?

Over the last 8months, several manufacturers and distributors were feeling a bit bitter on howsome of their Brands’ product ranges had been brutally reduced without priorinformation or consultation. Their challenge was not necessarily that thenumber of their Brands’ skus was reduced on shelves, but rather that theselection of the removed products was not optimal and ales opportunities werelost. The most frequent feedback we heard – and confirmed through a deep divein their range performances – was

- Medium performance skus were removed even though their distribution was not optimal

- The products performances analyses were sometimes done across all channels, preventing each channel specific shopping mission to be considered

- The Range Effect was being impacted every time only one SKU of that Brand was remaining on the shelf

- The Unit of Needs were not systematically considered (like in Tesco’s famous business case: Anchovies might have very low sales performances, but if they are purchased by the top 10 spenders of a sore, it becomes a problem)

- The strategic directions of the Brands were ignored (for example, a brand might want to push a specific variant of a product, even though it doesn’t perform well today)

- The Previous equilibrium of share of assortment was broken

And to the point of certain manufacturers, the rationalization impact on the category was sometimes affected as well.

How does Assortment Rationalization Work?

The idea behind rationalization is simple: if customers don’t buy a product, there is no need to have it on the shelves. Once again, it makes complete sense. The challenges come from the fact that the retailer has literally tens if not hundreds of categories to rationalize across several channels. As time is of the essence, the retailers’ teams do not always have the luxury of allocating enough time to doit as well as they – or you – wished.

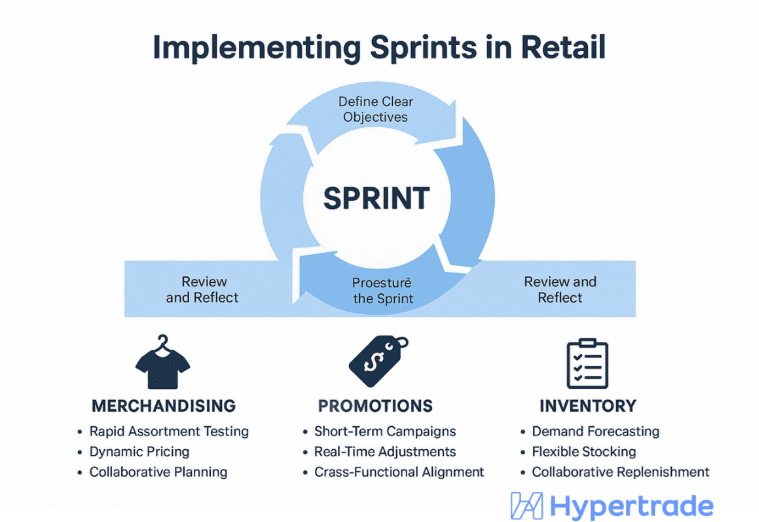

The rationalization exercise is like a major Range Review: it usually starts by setting up objectives and principles.

Rationalization measurements

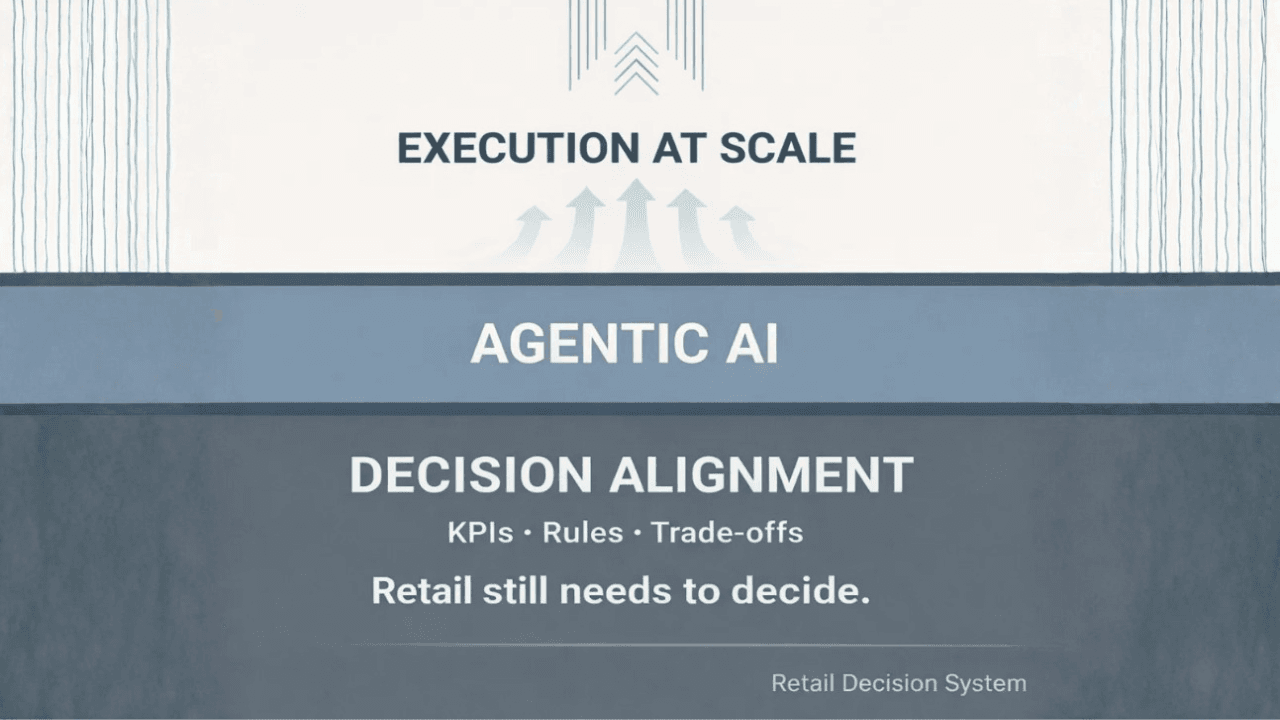

To drive the rationalization exercise, the retailer is going to select measurement targets. When the rationalization is complete, these measurements must be achieved. The most frequent are: Total number of skus or linear meter. The impact of sales, profitability and inventory will validate the best options.

Rationalization principles

Once the objectives are solidified, retailers are then going to apply, for each category and each channel, a certain number of principles (we can also call them constraints) that will guide the algorithm first – and the category managers – in the final decisions. The most frequent constraints are:

- Minimum sales quantities

- Facing by product type

- Number of products variants & number of products by variant

- Number of Brands

- Number of price points per selling price threshold

- …

Once these constraints are recorded in the algorithm; the machine will propose a list of items to keep or remove store by store. The final validation is often done by the Category Managers. Commercial agreements are often considered at that stage.

5 Actions to avoid being a Victim of Rationalization?

The rationalization exercise itself cannot be avoided. It creates similar benefits to manufacturers as it does to retailers, from supply chain to delivery, merchandising and return costs. There are XXX things to do adapt smartly to the reduction of your Brand’s range:

- Be informed about both the objectives and principles of the exercise. It will enable you to run your own calculations and projections

- Solidify the definition of “Non-Performing Items”

- If you can’t run the calculations, ask how many skus you can keep

- Propose your own skus choice and substantiate your selection with numbers

- Maintain your existing share of space – even with less SKUs – and propose supporting activities to maintain it

4 Ways to make your Brand win through Assortment Rationalization?

When your relationship with your favorite retailer are collaborative, you have normally been informed in advance about the rationalization exercise and when it will take place.

Of course, the 4 actions mentioned above will need to be executed. But you can do more than this.

Easy Approach: Anticipate

When you know what the measurements are selected and their target [ e.g.: we need to reduce the number of SKU by 40%], using simple POS data, you can:

- apply these 40% to you range

- Count the number of skus you will have to remove

- Select the critical skus you want to keep and ensure they are out of the agreed definition of non-performing items.

Professional Approach: Propose an Assortment type by Cluster

The approach is like the Easy approach, with one additional parameter in your selection of sku: baskets details. You will support you selection by integrating what is specific to each channel:

- average spending by customer

- number of items per basket

- Items penetration

This will help you ensure that the items you select to remain on shelves match shoppers’ expectations.

Brand’s aspiring to become Category Captain will do the same exercise on their competitors’ Brands and submit their selection as a suggestion.

Expert Approach: Propose an Assortment by Store

In addition to theProfessional Approach, the Brand’s own constraints must be added in thealgorithm. For example: number or type of flavor, associated purchases, packsize, price level, …

In each approach, it is recommended to run a simple projection that will measure the proposal impact on sales, concerned Brands’ effectiveness and inventory.