The discussion was organized by Chutipong Benjasatkul, the CEO of Italent, on 23 November 2022 in Bangkok.

Below are the questions and answers that were addressed during the discussion. Frederic Etienbled, CEO of Hypertrade, was the guest of Chutipong.

Question 1: What did you see change on the several retail markets HPT is servicing?

Across the markets we serve, while each has its own specificities, we identified 5 major common trends

a. Retailers’ Range rationalization

b. Brands’ new approach to shelves effectiveness

c. Change in Shopping Behaviors (Frequency and basket)

d. Increased usage of CRM and Personalization to not only drive traffic and spending,but also improve Customer Engagement ROI

e. Post-covid decline of online for CPG. In is interesting to see that today, at least in the US, Stores have become again the new the strongest media channel is now stores, with an audience almost double than digital audience.

Question 2: What do you see as the main challenges retailers need to solve?

In addition to rising costs and economic slow down, I believe retailers need to address 5 key challenges

a. Availability of course

b. Cash Flow, due to oversized ranges and lower comsumption

c. Profitability (heavy investments to drive traffic & basket and rising costs)

d. Omnichannel complexity & decline in digital commerce, where they did heavy investments

e. Capabilities & competencies’ Gap

Question 3: What are the common solutions you see retailers implementing?

Each retailer – each company – has of course its own priorities. Still, what we can see is that there are certain priorities that can be found across several retailers, whatever their size. In addition to a deeper integration of technology into the supply chain and ordering more specifically (availability and cash-flow increase), we can see 3 main trends.

a. They are working hard on Range rationalization, to optimize distribution, shelf-space, cashflow and availability. This include the setup or improvement of their current clusterization.

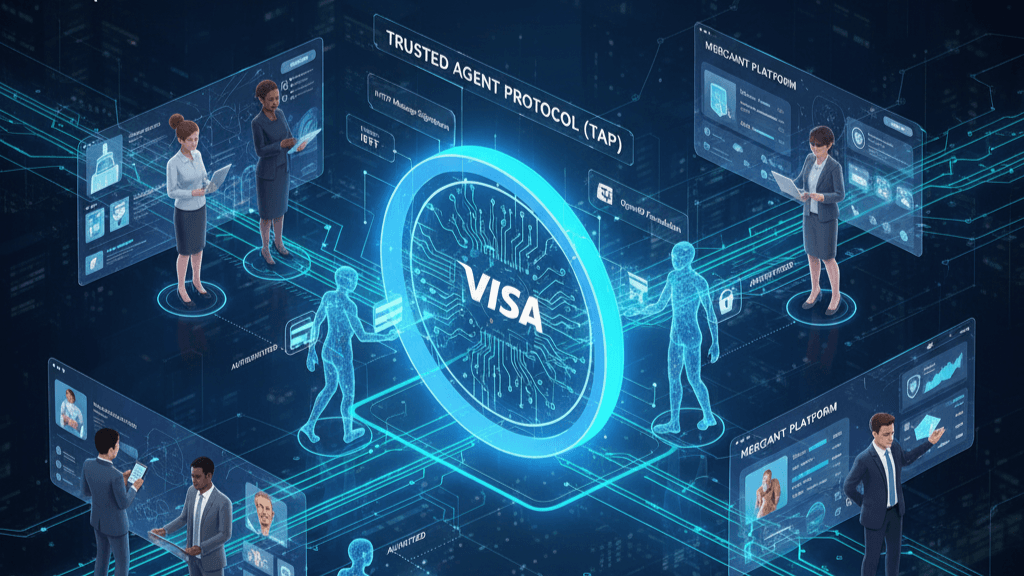

b. They are accelerating Data driven Category management, to not only improve the ROI of each decision in terms of products, promotion, and pricing, but also to increase Teams’ efficiencies. As strange as it may seem, retailers are not always the most advanced companies when it comes to digital transformation.

c. They are looking at all options to improve Suppliers’ collaboration with different objectives in mind: 1) engage suppliers’ capabilities more in their category strategies; 2) build customer engagement strategies; 3) automate as much as possible the creation of all document & information needed in the business relationship.

Question 4: In this context, what are the opportunities for Suppliers?

When one thinks about sales, we know that there are several sales technics used in B2B. There are for example the SPIN (Situation, Problem, Implication, Need Payoff) approach, the Solution Selling Approach, Gap Selling, etc…,

All these approaches have one point in common: they focus on identifying the pain of their customers and then propose solutions to not only cure the pain, but also deliver additional value at the category level

The key opportunity a crisis like this can offer is to elevate your relationship with retailers to a strategic level: support and anticipate their pain and challenges, and highlight the value your solutions can bring. For example,

a. Follow the rationalization trend and anticipate reduced, range and focus on what sells well

b. Be pro-active on your Brand’s distribution optimization

c. Systematically integrate Shoppers insights in your recommendations to ensure your strategy will address their specific needs in terms of traffic or spending

d. Help retailers identify and capture:

i. the category opportunities they can’t see due to a lack of time or resources

ii. The channel opportunities they can’t see due to a lack of time or resources

If we come back to basics sales training, it is about re-starting the conversation with a question: How can our Brands help you achieve your business objectives, implement your strategies and address some of your challenges?

The ideal stance would be: “After analyzing your data, our understand is that your have Opportunities A & B, and need to address Challenges 1 & 2. Is correct? I believe we can help”.

Question 5: What are your recommendations to Suppliers who want to capture such opportunities?

Building on our experience working with manufacturers, we could summarize this in “Embrace the collaboration opportunities to become a strategic partner”, with all the benefits a strategic partnership can deliver on range, distribution, promotion, display and innovation.

To break this down into action steps, we see 4 directions to make this happen

• The 1st one is a challenging one as it refers to a mindset: Make more efforts to understand not only retailers, but also the person in front of you, their job, their challenges. You need to speak their language

• The 2nd one if that once we decide to speak the Clients’ language, it implies that we are able to measure performances, successes and failures with their own metrics. Their metrics must become part of your KPI. What is success for you can be assessed very differently by them. This direction is critical to enable your company to embrace the Collaboration opportunities

• If one decides to place Retailers objectives at the centre of their decisions and positioning, then the 3rd recommendation is to embrace our new data-driven world: use data and analytics to take your decisions and validate your options. There are always lots of reasons to postpone these decisions, but it comes a time when embracing reality is required. Yes, transforming a company into a data-driven organization is not a picnic trip, nor is it done in a day, neither is it impossible. Different approaches exist, depending on each company’s size and maturity. Yes, it is going to take time, people’s energy and money. But Mistakes, approximation or misfires are becoming too expensive. Data should drive the majority of all the decisions that impact Top and Bottom lines of the company. Instinct or intuition are just the icing on the cake to be used very, very carefully

• Last but not least, and as challenging as it might sound, don’t stop investing, but increase your focus on your Return On Investment, and put this ROI at the centre of your joint decisions with retailers. A recent Mc Kinsey paper shared that companies that continue investing during tough times generate on average 37% more sales growth than their peers.

Question 6: Building on your experience with other manufacturers, what roadmap would you suggest?

In the way we look at it, we see 5 main stages, be it for physical or digital commerce:

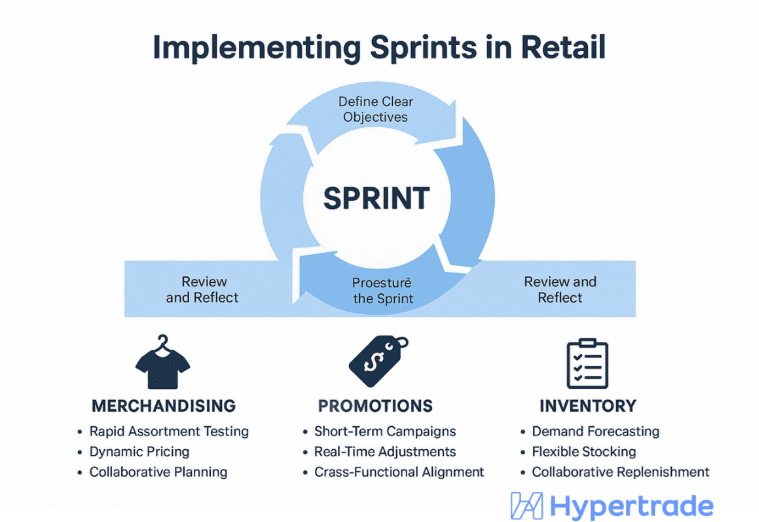

1. The 1st step is to map and review key commercial decision processes that impact top and bottom lines. Here we are talking primarily about your Range Management, Promotion Planning and Category Reviews. These 3 processes drive most of business decisions and support the main sales drivers.

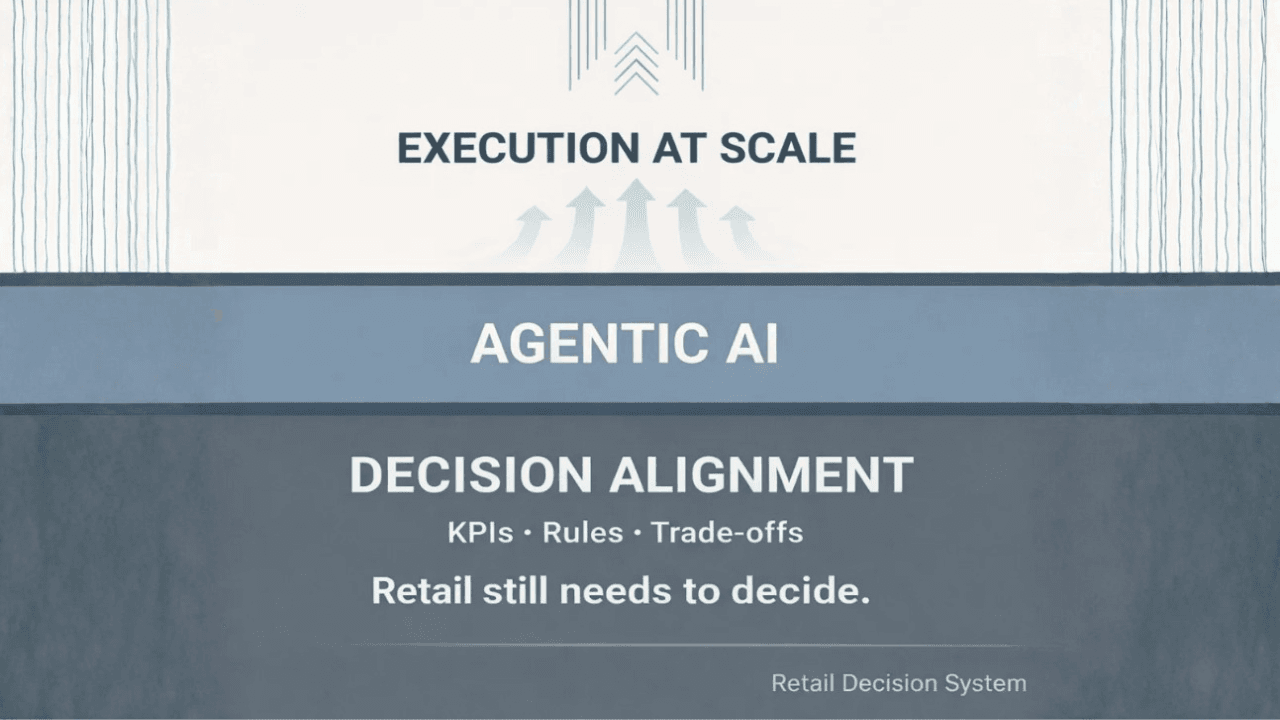

2. The 2nd Step is to identify, across these processes, where are the “Rules Gap”, meaning the absence of clear quantified conditions and rules that enable to decide what the next actions or decisions should be. At this stage, companies will usually define what actions the alerts’ thresholds will generate, as well as define the corrective actions to be taken.

3. The 3rd step is to identify, in these “Rules Gap”, where are the “Data gaps”, meaning the quantified information or data that should be used to solidify and fluidify the process

4. The 4th Step is to design, across the organization, what would be the optimal process if we had all the data and information required. At this stage, companies can also identify what are the potential missing competencies and tools required to make this optimal process work.

5. The 5th Step is the piloting, including training and monitoring. We reckon embarking on this Journey is not easy as it is necessary. It corresponds to an important part of establishing the foundation required for digital transformation

7. Question 7: What are the main challenges manufacturers will face if they want to start adapting to this new business approach?

From our experience, – and once again each company is unique – common challenges companies face when undertaking this transformative approach are:

Denial: it takes some time, and financial projections, to admit that:

a. There are no other alternatives

b. The investment will deliver one of the best ROI in medium term

Doubt: it is not easy to re-think parts of the company or working habits. Will we succeed? Do we have the right talents? Will the Teams buy in? How much will it cost? Can we afford it? Will I be able to manage this? We have been quite successful so far, why change? These are quite natural and healthy questions to ask.

Fear : a transformation – or evolution – takes time, energy and effort. We are here talking about 3 converging projects: re-aligning working processes, elevating teams’ capabilities and setting up automated technology to make it happen with agility. How will we manage such a journey? What are the risks? Will the teams follow? Are we “ready” enough?…

Resistance: even though we are familiar with the idea that What brought us here won’t get us there. Nobody likes to change. There is an important fear factor here, then often drive resistance at all levels in the Company from Shareholders to Salespeople on the field.

Question 8: What are the most frequent Quick Wins manufacturers can capture when starting this new journey?

There are quite a few:

• On financial perspective, the first benefits manufacturers can capture from using data more effectively is the sales growth thru optimization of their distribution. It can generate up t 5% additional sales. These gains also impact the retailers, which reinforce the relationship:

• Time saving is obviously a major gain

• On the Human side, Teams usually appreciate the fact that efforts will be done to elevate their skills and competencies or compensate a share of the lack of competencies by technology and automation.

Question 9: Can you share a successful Business case of a manufacturer who implemented such changes and what results it delivered?

Yes, absolutely. The company I refer to is a Cookies & Snack manufacturer. The first challenge they tackled was their range Optimization.

Data made them realize that they had to optimize their range: some items were distributed in the wrong channels (it was costing them money for nothing) and that some of their top selling items were not in all the channels they should be (they were losing sales opportunities).

Sales grew and distribution costs decreased. Overall, they could increase their range effectiveness by more than 10% in all channels. Once they rationalized their range management process by Brand and set up the supporting processes, they tackled the promotion challenges.

While they were not challenging promotions investments, their problem was double sided: 1 a large number of promotions were not translated in the expected increased sales and market share, and 2, they had a very limited visibility on the global promotion effectiveness at the retailers’ category level.

Poor planning, products, and mechanics selection were at the origin of these challenges. So they started analyzing their performances and the whole category, established promotion planning and selection rules, and set up a very more detailed approach to promotion performances analyses.

After 6 months, they could improve the Promotion ROI by 20%Now, they are at the stage where joined internal collaboration between Marketing, Insights and Sales teams are now driving decisions for range, product launches, distribution and promotions.

Conclusion: on the one hand, you say that growth in current times requires more agility for quick and efficient responses in a short time period. On the other hand, you are recommending evolution and changes, from mindset to working processes and tools, that require a longer-term approach and ROI. How do you manage this antagonism between Short and Medium Term?

It is an excellent question. I was reading last weekend another white paper from Mc Kinsey saying that while it was critical to be agile and hyper-reactive to fast changing customer behaviors, it was also worth considering a new approach to Managers’ incentives by creating multi-year incentive schemes.

What I believe we all know as businesspeople and managers in this room today, is that it takes time to get the company ready to embrace change. In other words, we need to invest time and effort to be able to save time and gain in performances. When we look at the future, and even now, we are all aware that data and digitalization are only to gain more importance.

And that we need to build and develop the capabilities to maximize their usage. We are also aware of the fact that the more we delay our decisions to move towards this data and digitalization direction, the more difficult it will be to make these changes happen. The short-term imperative is to start now, and the medium term imperative is to plan carefully a step-by-step roadmap.

On a personal note, I believe the Formula for Change summarizes the mindset quite well. It says that Change can happen only if the driving force is stronger than resistance. And the driving force is made of 3 components: The awareness of the difficulties, The vision of what a better future can be and the first steps to move towards its.

The Long term is the Vision, and it concerns the whole company.

The short term – and the gains we mentioned earlier – are the first steps we can do to move forward with Sales & Marketing teams, bringing them closer to a quantified understanding of Shoppers and the actions required to address behavior changes.